Insurance terminology

Commonly used insurance terms include:

- Party: an individual or company.

- Third party: an individual or company that does not have a direct connection with an insurance policy but may be affected by it.

- Insurer: The company providing the insurance cover in the form of a policy.

- Insured: the beneficiary of any financial recompense or benefit that may be paid out under the terms of the insurance policy. The insured is usually liable to pay the insurance premium at the start of the policy and at renewal – if renewal is applicable.

- Policy: the set of clauses which taken together constitute the insurance cover and includes the duration of cover and the terms and conditions as applied to the project.

- Cover: the items, situations and events that the policy provides insurance for e.g cover against theft and damage.

- Period of insurance: the period of time over which the insurance policy provides cover.

- Premium: the amount payable (usually on an annual basis) for the benefit of insurance cover.

- Excess: the amount of any loss that the insured must pay before receiving any benefits under the insurance policy. If a policy has an excess of £200 and the insured claims £500 for a loss suffered, the insured party must pay the first £200 of the loss and so will ultimately receive £300.

- Indemnity: security against hurt, loss or damage.

- Policy limit: the total amount the insurer has to pay under a policy.

- Primary layer/excess layer: the cover provided by a particular policy when arranged in layers. Once the primary layer is consumed, the next layer is triggered…and so on.

See also:

- Building Users' Insurance Against Latent Defects.

- Collateral warranties.

- Contract works insurance.

- Contractors' all-risk insurance.

- Directors and officers insurance

- Employer's liability insurance.

- Excepted risk.

- Flood insurance.

- Indemnity to principals.

- Integrated project insurance.

- JCT Clause 6.5.1 Insurance.

- Joint names policy.

- Latent defects insurance

- Legal expenses insurance

- Legal indemnity insurance.

- Non-negligent liability insurance.

- Office combined/contents/buildings insurance

- Performance bond

- Professional Indemnity Insurance.

- Public liability insurance.

- Residual value insurance.

- Reverse premium.

- Specified perils.

- Subcontractor default insurance (SDI).

- Terrorism insurance

Featured articles and news

Latest Build UK Building Safety Regime explainer published

Key elements in one short, now updated document.

UKGBC launch the UK Climate Resilience Roadmap

First guidance of its kind on direct climate impacts for the built environment and how it can adapt.

CLC Health, Safety and Wellbeing Strategy 2025

Launched by the Minister for Industry to look at fatalities on site, improving mental health and other issues.

One of the most impressive Victorian architects. Book review.

Common Assessment Standard now with building safety

New CAS update now includes mandatory building safety questions.

RTPI leader to become new CIOB Chief Executive Officer

Dr Victoria Hills MRTPI, FICE to take over after Caroline Gumble’s departure.

Social and affordable housing, a long term plan for delivery

The “Delivering a Decade of Renewal for Social and Affordable Housing” strategy sets out future path.

A change to adoptive architecture

Effects of global weather warming on architectural detailing, material choice and human interaction.

The proposed publicly owned and backed subsidiary of Homes England, to facilitate new homes.

How big is the problem and what can we do to mitigate the effects?

Overheating guidance and tools for building designers

A number of cool guides to help with the heat.

The UK's Modern Industrial Strategy: A 10 year plan

Previous consultation criticism, current key elements and general support with some persisting reservations.

Building Safety Regulator reforms

New roles, new staff and a new fast track service pave the way for a single construction regulator.

Architectural Technologist CPDs and Communications

CIAT CPD… and how you can do it!

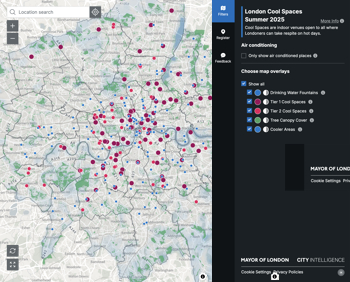

Cooling centres and cool spaces

Managing extreme heat in cities by directing the public to places for heat stress relief and water sources.

Winter gardens: A brief history and warm variations

Extending the season with glass in different forms and terms.

Restoring Great Yarmouth's Winter Gardens

Transforming one of the least sustainable constructions imaginable.